A growing sector designed to support decarbonization

Carbon management is one of many tools available to support widespread decarbonization and the achievement of the Paris Agreement goals. It uses technologies commonly known as carbon capture, utilization, and storage (CCUS), including direct air capture (DAC) and bioenergy with carbon capture and storage (BECCS) to reduce current emissions and remove legacy emissions. In this way, the developing sector supports realizing the “net” in net zero, and the decarbonized production of energy and materials such as steel, cement, and chemicals.

However, CCUS technologies, and the carbon management sector they underpin, have been the focus of significant debate in recent years. While, most agree that limiting global temperature rise requires decarbonization, not everyone agrees that carbon management should be part of the solution. Unfortunately, this debate skews public perception away from mature technologies that are a critical part of the decarbonization tool kit.

The role of carbon management should be limited in energy transitions. It is not a substitute for renewable energy deployment or energy efficiency measures. It should not sustain business-as-usual energy production with fossil fuels. Instead, carbon management should support abatement of emissions that are otherwise locked in or cannot be readily eliminated using other technologies. It also should be used to provide durable carbon dioxide removals (CDR).

In practice, this means that carbon management is needed in industry to address process emissions and emissions generated by high-temperature heat production. It can also play a role in decarbonizing the power sector and unlocking low(er) emissions fuels. Finally, technologies like DACS and BECCS are needed to address legacy and residual emissions.

Limited carbon management still requires a very large sector

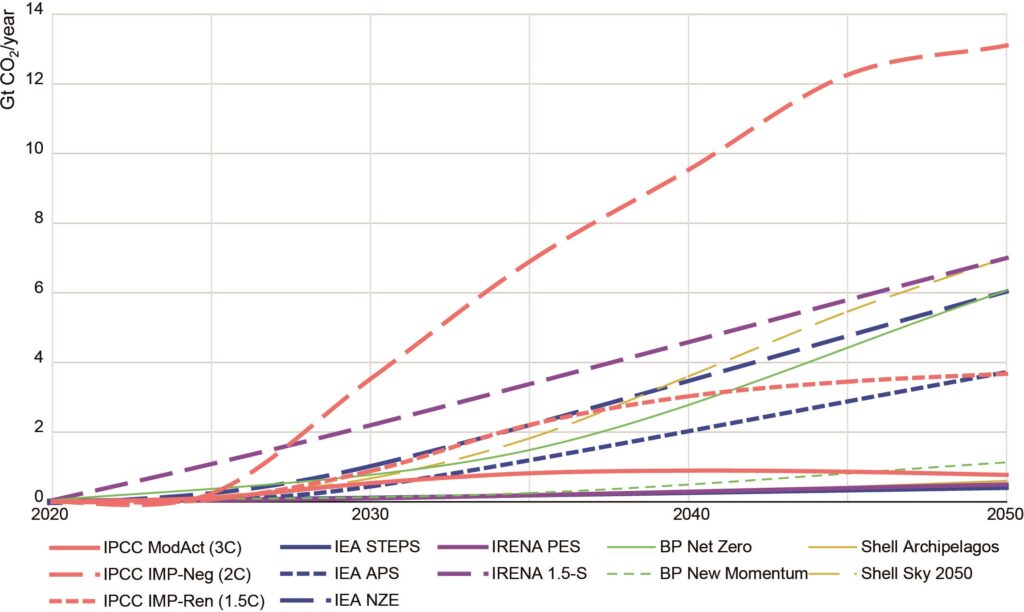

Energy scenarios examine how the sector could evolve with time. Assumptions and known data are used to project how different policies, ambitions, energy demands, etc. may affect the energy sector. Many organizations produce scenarios. Today, the most ambitious energy transition scenarios often align with the goal of the Paris Agreement.

Scenarios limit the deployment of carbon management by balancing it against other decarbonization levers such as renewable energy, energy efficiency, low-emissions fuels, etc. An examination of carbon management deployment in different scenarios suggests that “limited” carbon management will require a dedicated sector.

Several scenarios suggest that between 3.8 Gt and 13 Gt of annual CO2 capture capacity is needed in 2050 to keep Paris Agreement goals in reach. The majority of these scenarios, including the International Energy Agency’s Net Zero by 2050 (IEA NZE), International Renewable Energy Agency (IRENA) 1.5°C scenario, and Bloomberg NEF Net Zero Scenario (BNEF NZS), target between 6 and 7.5 Gt of CO2 capture by 2050. The two outliers (3.8 Gt and 13 Gt) come from Intergovernmental Panel on Climate Change (IPCC) Illustrative Mitigation Pathways (IMPs). IMP-Neg-2.0 deploys extensive CDR to achieve negative emissions while IMP-Ren relies heavily on renewable energy deployment.

Scenarios suggest over 1 Gt/yr of CO2 capture capacity is needed by 2030

To meet align with the decarbonization pathways presented by these scenarios, deployment of carbon management technologies needs to accelerate rapidly between now and 2030. In the next six years, annual CO2 capture capacity needs to scale from around 55 Mt to between 1 and 2 Gt. Deployment will further need to scale to above 3 Gt by 2050. Scaling the sector requires substantial investment and the development of an entire CO2 value chain.

Evolution of CO2 capture capacity in different scenarios

How much carbon management is needed?

To build a case for the necessity of timely investment into carbon management, we can compare the size of the future carbon management sector to today’s oil and gas sector. Based on the aforementioned scenarios, by 2050 we will need between 3.8 and 7 Gt of annual CO2 capture capacity globally, along with the associated infrastructure to transport and store it. For reference, demand for crude oil in 2023 amounted to around 37 billion barrels of crude oil. By weight, that comes to about 4.9 Gt (assuming 0.133 tonnes per barrel based on the density of Brent crude). Globally, supplying the oil to meet this demand supports the employment of approximately 7.6 million people. By 2050 the carbon management sector will handle CO2 equivalent in mass to between 75% and 140% of today’s global crude oil demand according to the previously mentioned scenarios.

In addition to the decarbonization benefits that carbon management supports, investments made now to scale the sector today will lead to significant employment opportunities in carbon management during energy transitions and beyond. As energy transitions proceed and demand for fossil fuels goes down, employment in the oil and gas sector will fall. The two sectors have an overlap in required skills. This suggests that some of the oil and gas workforce could find employment in carbon management.

Transport and storage infrastructure is critical

CO2 capture is just one part of the equation. Moving and storing captured CO2 requires substantial infrastructure. Similar to crude oil, ships and pipelines are the main transport options for CO2. Monitoring and injection wells are an essential part of CO2 storage.

Today, oil moves around the world through over 380,000 km of pipelines and via 11,600 oil tankers. In comparison, there are about 9,500 km of CO2 pipelines in operation globally, and there are no large-scale CO2 tankers. While the food and beverage industry currently transports small volumes of CO2 by ship, no CO2 shipments of the scale needed for global carbon management are occurring today. However CO2 shipping for carbon management is in development. Last year Northern Lights, the carbon management company most advanced in developing CO2 shipping for carbon management, announced that it is expanding its fleet of CO2 ships to four. The first two ships were launched in April 2024.

When injected into geological reservoirs, CO2 remains isolated from the atmosphere for hundreds to thousands of years. CO2 storage sites are a critical part of the carbon management sector. Multiple types of CO2 storage resources exist, and most believe that there are sufficient resources available to support the carbon management sector. That said, globally we need to accelerate resource assessment and development. Today, the Storage Resource Management System would classify most resources “Undiscovered”, however there are initiatives in place to accelerate resource assessment.

There are benefits beyond emissions reduction

The benefits of carbon management are clear. The sector can directly support:

- Emissions reduction in power and industry

- Production of low-emission fuels including hydrogen, sustainable fuels produced with CO2 captured from the air, and biofuels with reduced emissions when CO2 is captured during their production

- Realization of carbon removal by capturing and storing CO2 from both the air and biomass

Additionally, carbon management comes with other co-benefits. For instance, plants usually upgrade their flue gas treatment systems to reduce the pollutants that would enter the capture module when they embark upon carbon capture installations. As a result, the amount of particulate matter and other pollutants usually decreases. This improves air quality.

Business cases for carbon management will account for capture costs

Detractors of carbon management often say that it is too costly and that the technologies that underpin the sector have not met expectations. These two criticisms are intertwined. In the absence of policy and regulatory levers prompting decarbonization, it is often cheaper to emit than it is to manage CO2. This is changing as more jurisdictions consider implementing carbon taxes, developing carbon markets, and/or mandating emissions control. Subsidies can also support the development of carbon management by decreasing the cost of abatement.

Business cases for carbon management are evolving everyday as countries update their policies, introduce new subsidies, and advance the development of legal and regulatory frameworks. These developments can increase the bankability of projects and will hopefully result in significant investment in the near term.

Different parts of the carbon management value chain have widely different costs and cost considerations. CO2 capture is often the most costly part of the value chain. These facilities are capital intensive. Additionally, they often have high operating expenses (OPEX). The cost of capturing CO2 depends on the purity of the CO2 stream:

- CO2 capture on highly concentrated CO2 streams, costs between USD 15-25/t CO2

- Capture on more dilute streams, such as those generated by cement production or power generation, can cost USD 40-120/t CO2

- CO2 captured directly from the air currently costs between USD 600-1,000/t CO2

CO2 capture costs should decrease as the technologies become more widely deployed. Additionally, some sectors will have no choice but to deploy CO2 capture if they want to have CO2 neutral or net-negative operations.

Carbon management will be a cost of doing business

Why would a company capture and store their CO2 emissions if they can emit them for free? Residents of 18th century London asked a similar question about the management of solid waste. At the time, most waste was dumped into streets or waterways. Following a series of cholera outbreaks, individuals started to call for the government to regulate waste disposal in order to improve the health and well-being of the population. Today, nearly all countries regulate the disposal of solid waste. Increasingly, countries are starting to regulate CO2 emissions as well. There are many parallels between waste and carbon management. Both address substances that have limited value and both derive their value from the environmental improvements that they create.

In a net-zero world, industries will need to be carbon neutral or carbon negative. Different industries will have different options. In power generation, renewable energy is the most critical decarbonization pathway. Carbon management can support flexibility in the power sector, but decarbonization can proceed without it. In industry, carbon management needs are sector dependent. In the iron and steel sector, low-emission hydrogen-based, direct reduced ironmaking (DRI) is a key lever for decarbonization, as are electric arc furnaces. These two pathways do not eliminate all emissions, but they address a substantial portion of them. Nevertheless, carbon management may be a competitive option for decarbonizing young blast furnaces. The cement sector has more limited options due to the substantial process emissions that come from clinker production. For that sector, carbon management is the main decarbonization lever.

Key takeaways

Carbon management is one of many tools available to support emissions reduction in industry. It is an indispensable lever for the cement sector and can support decarbonization in steel and other industrial sectors. High capture costs are a barrier, but they should decrease as we move beyond first-of-a-kind projects.

Carbon management underpins a substantial volume of carbon dioxide removal. According to the IEA, carbon dioxide removals in 2050 amount to 1.7 Gt of CO2. Direct air capture with storage and bioenergy with carbon capture and storage are key technologies for durable CDR.

In 2050, the carbon management sector will have a similar size as today’s oil sector. The growing sector can be a key employment opportunity and will be a growth area for investment.

Carbon management as elephants and whales

The IEA’s Net Zero Scenario includes 6.04 Gt of carbon management in 2050. Depending on how the carbon management sector develops, between 100,000-600,000 km of CO2 pipelines will be needed to move captured CO2. That is equivalent to circling the equator 2.5 to 15 times. In comparison, end-to-end, the 380,000 km of crude oil pipelines in use today would circle the equator 9.5 times.

African Savannah Elephants can weigh up to 6.8 tonnes and are around 7.3m long. In 2050, around 900 million elephants’ worth of CO2 will need to be captured, transported, and stored. Based on the IEA’s assessment of pipeline needs, in 2050 there will be between 13,700 and 82,200 elephant-lengths of CO2 pipelines.

Blue whales weigh between 130 and 150 tonnes and are up to around 30m long. Come 2050, CO2 amounts to the weight of around 40 million blue whales moving through a total of 3,300-20,000 blue whale-lengths of pipelines.